Chainalysis: Cryptocurrency Scammers Earn $ 7.7 Billion in 2021

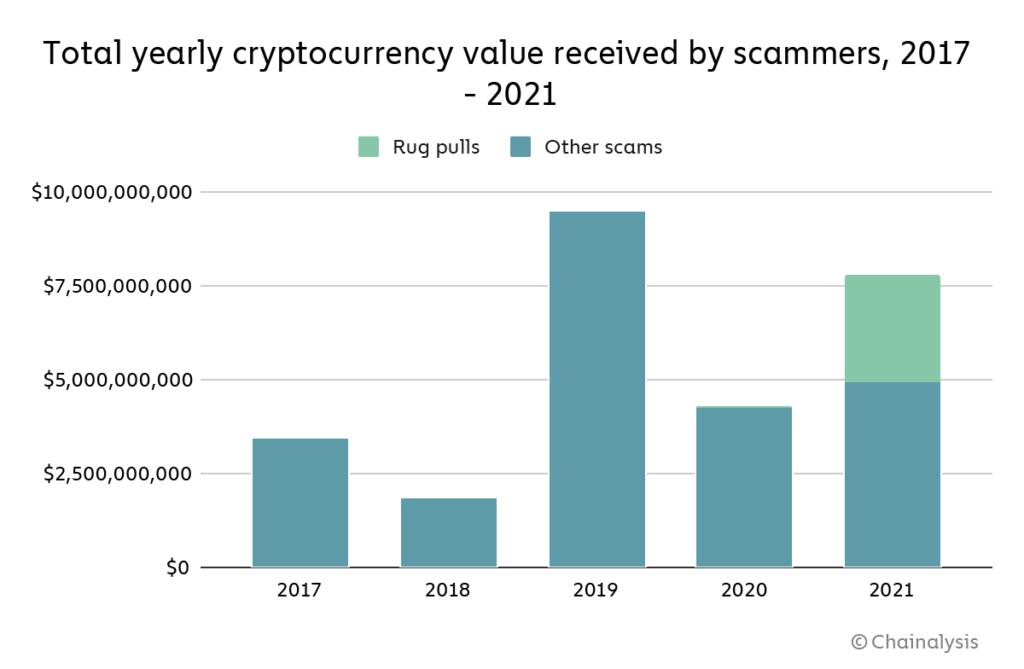

Blockchain analysts from Chainalysis have summed up the results of the year – according to their data, cryptocurrency scammers “earned” about $ 7.7 billion in 2021.

Overall, the losses suffered by victims increased by 81% compared to 2020, when the activity of fraudsters decreased significantly (compared to 2019). According to experts, this was due to the lack of any large-scale Ponzi schemes. For example, in 2021, approximately $ 1.1 billion in losses is the result of a single Finiko pyramid targeting Russia and Ukraine.It is also reported that the number of deposits to fraudulent accounts this year decreased from 10.7 million to 4.1 million, which may mean that there are fewer individual victims of fraud, but they have lost more.

According to experts, the main source of losses in 2021 is the so-called “rug pull” schemes, when the developers of a new cryptocurrency disappear and take with them all the funds of investors and enthusiasts. In 2021, such a scam accounted for 37% of all scammers’ income, that is, approximately $ 2.8 billion.

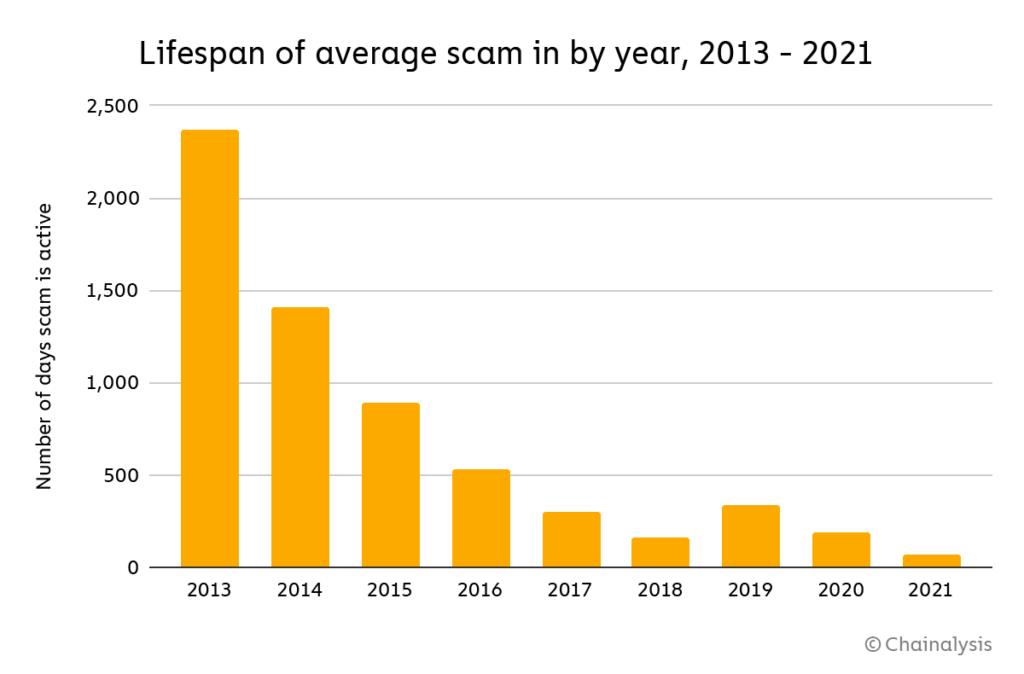

Interestingly, at the same time, the average “life” of fraudulent schemes has decreased and in 2021 was only 70 days (versus 500 days in 2016).

Against the background of the Chainalysis study, reports of the authorities’ struggle against crypto scammers resemble a drop in the ocean: FBI seized $ 2.3 million in cryptocurrency from partner of hack groups REvil and GandCrab as well as US authorities imposed sanctions on cryptocurrency exchange Suex.